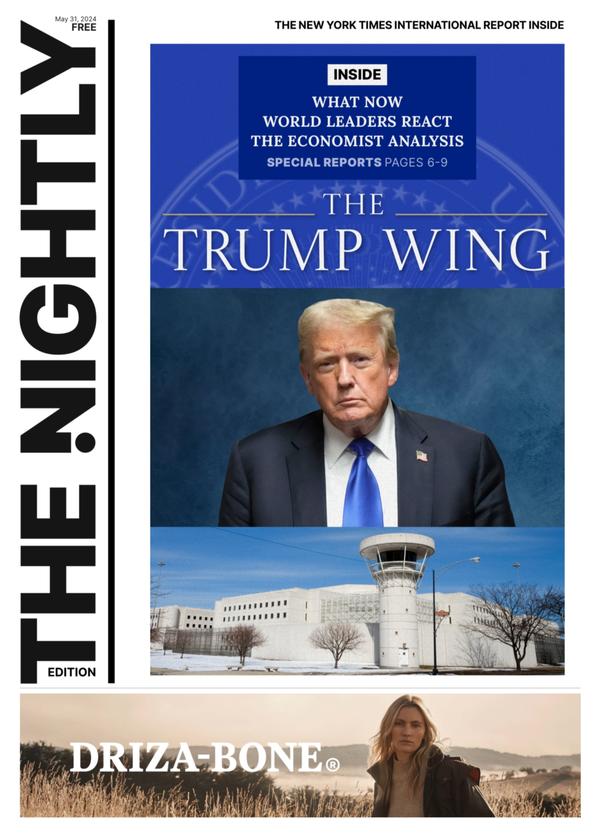

Brisbane buyers agent Lauren Jones says the number of first homebuyers in their 40s and 50s is on the rise

The number of first-home buyers in their forties and fifties is rising as soaring house prices drag out the length of time it takes to save a deposit.

Brisbane buyers agent Lauren Jones said it is now quite common to see middle-aged buyers entering the property market for the first time.

“Property prices are at record levels in Brisbane, Adelaide and Perth, and not far off peak in Sydney and Melbourne, which means the deposit hurdle is getting higher and higher. As a result, it’s taking people longer to buy their first home,” she said.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“I’m getting enquiries from people in their forties and fifties who want to buy their first home. That would’ve been unusual a generation ago but is now quite common.”

Ms Jones said she helped one client in her mid-forties purchase her first home who had been looking for about four years to buy something.

“What it really came down to was a lack of confidence. Women tend to save and procrastinate, I think they probably overanalyse the decision,” she said.

Ms Jones said a majority of the older first-home buyers she dealt with were women.

In contrast, she said men tended to buy their first home at a younger age, thanks to generally higher incomes and more confidence.

“The older female first-home buyers I speak with are absolutely lovely but can be a little low on self-confidence. They’re single now but may have come out of a long-term relationship.”

According to Ms Jones, many banks still offered 30-year loans to this older age group if they had a suitable exit strategy.

“We’ve even just recently purchased for a lady in her sixties. It was her first home as she’d been living at her parents’ place all her life and she actually used her superannuation and a bit of a cash inheritance,” she said.

“Mortgage repayments are high, but so is rent.”

She said it was also becoming increasingly more common for first homebuyers, whatever their age, to enter the competitive property market with financial help from family.